Blggzz: Your Daily Dose of Insight

Stay updated with the latest news and informative articles.

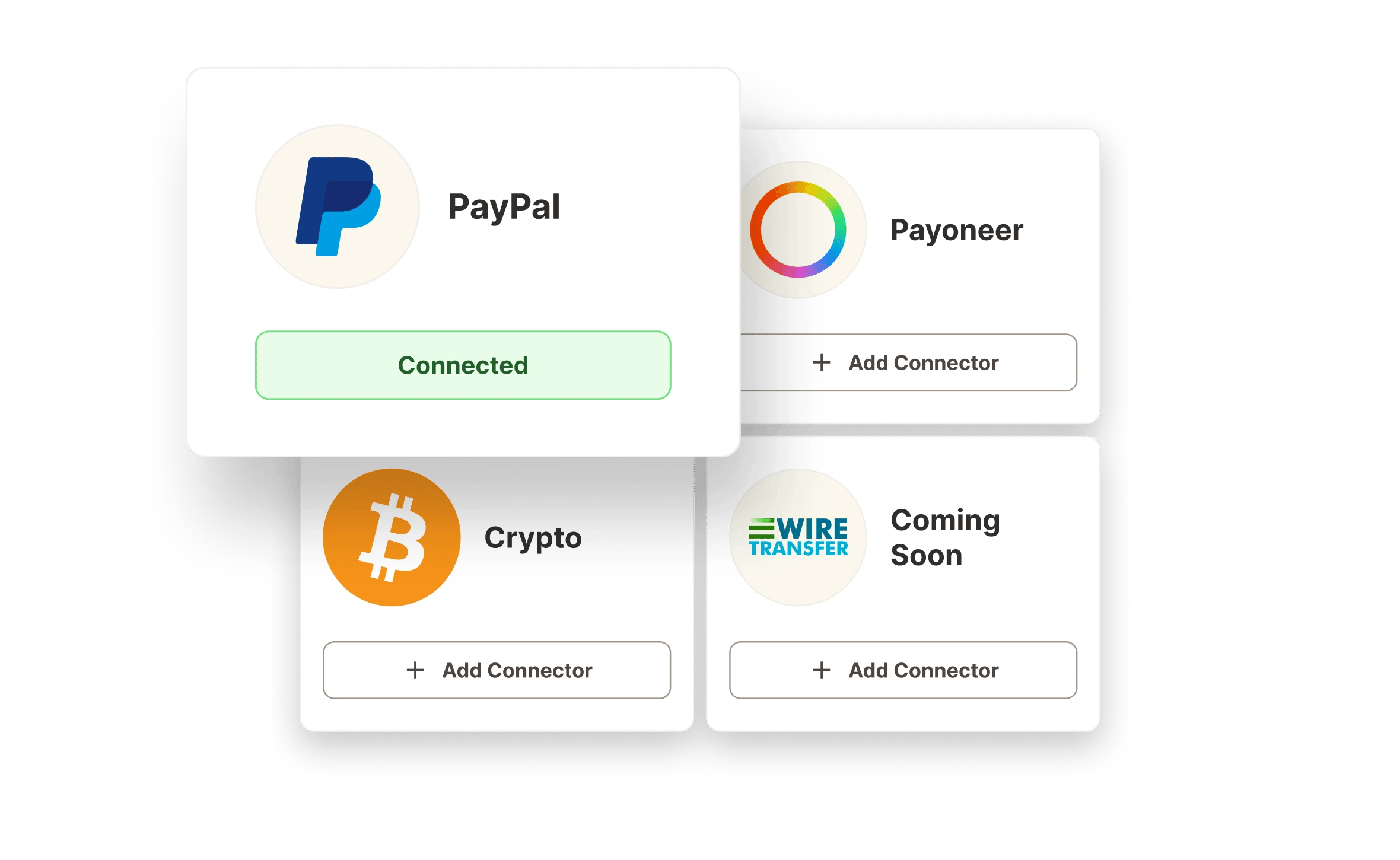

Crypto Cents: How Automation is Reshaping Payouts

Discover how automation is revolutionizing payouts in the crypto world. Unlock the secrets to maximizing your earnings today!

Understanding Automated Crypto Payouts: Benefits and Challenges

Automated crypto payouts have revolutionized the way businesses and individuals manage transactions in the digital currency space. By streamlining the payment process, these automated systems assist in reducing operational costs and minimizing errors associated with manual transactions. One significant benefit of using automated systems is the ability to process a large volume of payouts quickly, ensuring that users receive their funds almost instantly. Moreover, automated crypto payouts facilitate smoother cross-border transactions, as they eliminate the need for intermediaries and allow users to bypass traditional banking limitations.

However, alongside these benefits, there are also challenges to consider when implementing automated crypto payout solutions. Security risks loom large, as automated systems may be prime targets for hacking or fraudulent activities. Additionally, the volatility of cryptocurrency prices can lead to potential discrepancies in payouts if not managed appropriately. Companies looking to adopt these systems must also navigate the complex regulatory environment surrounding cryptocurrency, which can vary significantly from one jurisdiction to another. Adopting a robust strategy that includes security measures and compliance with regulations is essential for reaping the full benefits of automated crypto payouts while minimizing associated risks.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in a variety of objectives. Players can engage in intense battles, performing strategic maneuvers and adapting to their opponents' tactics. If you're looking for an advantage in your next gaming session, check out the duel promo code to enhance your gameplay experience.

How Smart Contracts are Revolutionizing Payment Processes in Cryptocurrency

Smart contracts are changing the landscape of payment processes in the cryptocurrency sphere by introducing automation and transparency. These self-executing contracts, embedded within blockchain technology, automatically enforce and execute the terms of an agreement without the need for intermediaries. This revolutionary approach significantly reduces transaction costs and processing times, allowing users to make quick payments with enhanced security. As a result, businesses can rely on cryptocurrency payments that are not only efficient but also devoid of the risks associated with traditional financial systems.

Furthermore, the use of smart contracts facilitates trust among parties involved in a transaction. Since all parties have access to the same information, the chances of disputes are minimized. For instance, escrow services can be handled effectively through smart contracts, ensuring that funds are released only when predetermined conditions are met. This level of automation is a game changer for industries such as real estate, insurance, and e-commerce, where transactions often involve multiple stakeholders and complex processes. By leveraging smart contracts, the future of cryptocurrency payments looks promising, with increased adoption anticipated across various sectors.

What You Need to Know About Automation in Crypto Transactions

Automation in crypto transactions is transforming the way users engage with cryptocurrencies, allowing for increased efficiency and reduced human errors. By utilizing smart contracts and automated trading bots, crypto enthusiasts can execute trades and manage their portfolios with minimal intervention. As the digital currency landscape evolves, understanding the mechanics behind these automations is essential. For instance, automated trading systems operate 24/7, leveraging algorithms that analyze market trends and execute trades based on predefined parameters, making them highly effective for maximizing profits.

However, while automation in crypto transactions offers numerous benefits, it also comes with risks. Vulnerabilities in the code behind smart contracts can lead to significant financial losses if exploited. Additionally, reliance on automated systems can make traders complacent, leading to a lack of awareness about market fluctuations. Therefore, it is crucial to strike a balance between utilizing automated tools and maintaining a strong understanding of the crypto environment. As you navigate this landscape, consider implementing best practices, such as regularly auditing your automated systems and staying informed about potential risks and innovations in the industry.