Blggzz: Your Daily Dose of Insight

Stay updated with the latest news and informative articles.

Digital Asset Trading: A Game of Risk or Reward?

Discover whether digital asset trading is your path to riches or a gamble that could cost you everything. Dive in for insights!

Understanding the Risks: What You Need to Know About Digital Asset Trading

In recent years, digital asset trading has gained immense popularity as investors seek new opportunities in the evolving financial landscape. However, with these opportunities come inherent risks that traders must understand. One of the primary risks associated with digital asset trading is market volatility, which can lead to significant fluctuations in asset value within short periods. To mitigate these risks, it is crucial for traders to stay informed about market trends, utilize risk management strategies, and be prepared for sudden price shifts. Additionally, engaging in thorough research and analysis can help traders make informed decisions.

Another critical risk factor to consider is the security of digital assets. With the increasing number of hacks and breaches in the cryptocurrency space, protecting your assets is paramount. It is advisable to utilize secure wallets, enable two-factor authentication, and be cautious of phishing scams that can compromise sensitive information. Furthermore, digital asset trading is often accompanied by regulatory uncertainties, as governments worldwide are still developing frameworks for digital currencies. Traders should familiarize themselves with the legal implications in their jurisdictions to avoid potential penalties or restrictions on their trading activities.

Counter-Strike is a popular first-person shooter that has captivated gamers since its inception in 1999. Players can engage in thrilling tactical gameplay, often requiring teamwork and strategy. To enhance your gaming experience, you might want to check out the daddyskins promo code for some exciting in-game enhancements and skins.

Exploring the Rewards: How Digital Asset Trading Can Benefit You

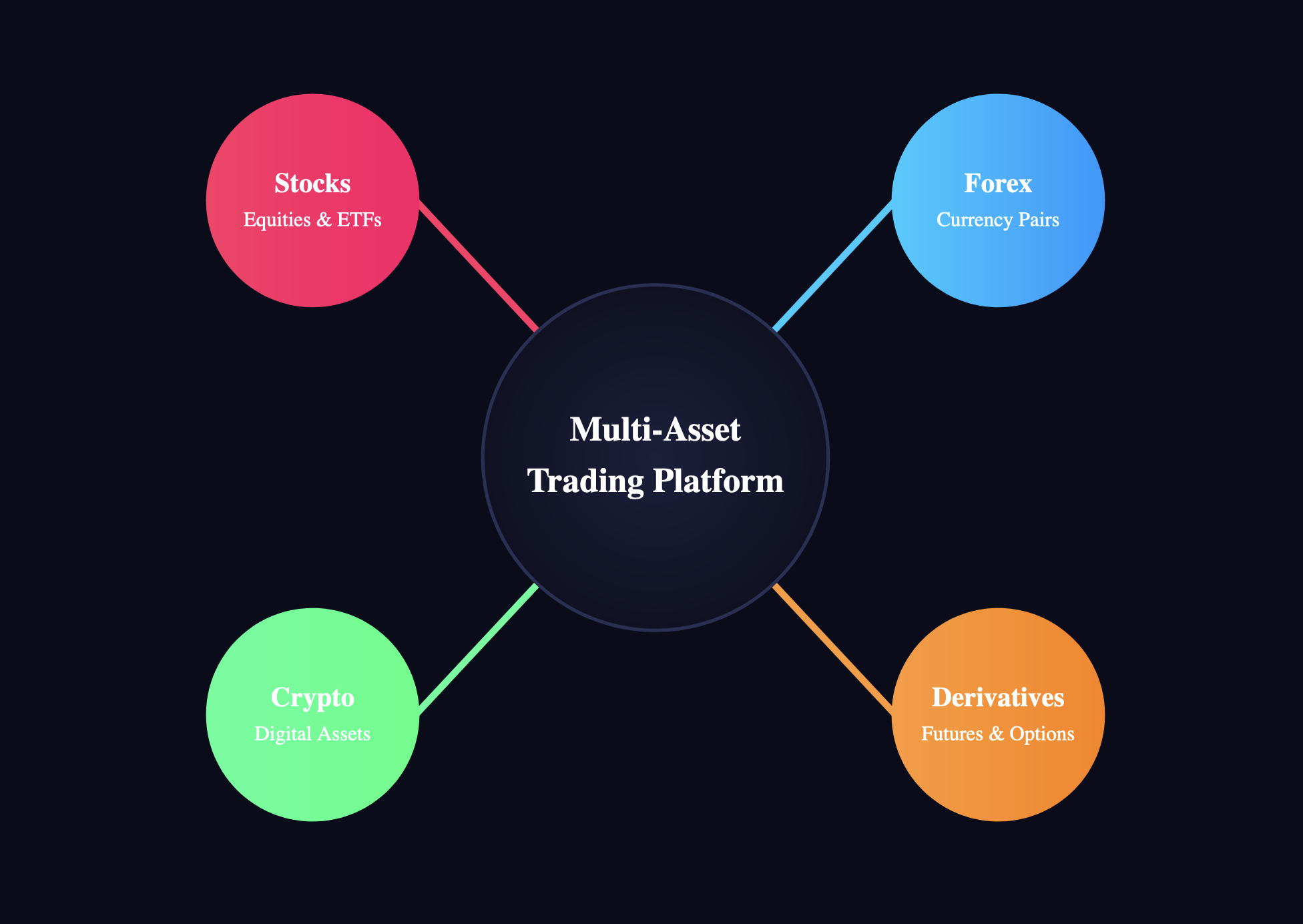

In today's digital age, digital asset trading has emerged as a lucrative avenue for individuals seeking to diversify their investment portfolios. By participating in the trading of cryptocurrencies, NFTs, and other digital assets, you can access a dynamic market that operates 24/7, unlike traditional stock exchanges. This constant availability offers you the flexibility to monitor and engage in trades at your convenience, potentially capitalizing on price fluctuations. Furthermore, as more people recognize the value of digital assets, the demand and liquidity in this sector are likely to increase, providing substantial rewards for early investors.

Beyond the financial incentives, engaging in digital asset trading also allows for the development of valuable skills and knowledge. As you navigate this complex market, you’ll gain insights into market trends, trading strategies, and risk management techniques that can benefit you in various areas of your financial life. You can also connect with a global community of traders, sharing experiences and strategies that can enhance your trading proficiency. Therefore, not only can digital asset trading yield monetary benefits, but it also cultivates a deeper understanding of the evolving digital economy.

Is Digital Asset Trading Worth the Gamble? Key Factors to Consider

The world of digital asset trading has gained immense popularity in recent years, with many investors viewing it as a potential gold mine. However, as with any investment, it comes with its own risks. When considering whether digital asset trading is worth the gamble, factors such as market volatility, asset liquidity, and regulatory issues should be taken into account. Market volatility can lead to significant price fluctuations over a short period, meaning that what appears to be a lucrative opportunity could quickly turn into a loss. Moreover, understanding the liquidity of the digital assets you trade is crucial; if the market for a specific asset is thin, selling at a desirable price could be challenging.

Another critical aspect to contemplate is the regulatory landscape surrounding digital asset trading. Regulations vary widely across different countries, which can impact the legality and operation of trading platforms. Additionally, staying informed about potential government interventions or changes in policy is essential for managing risks. To summarize, if you're considering diving into digital asset trading, evaluate these key factors: market volatility, asset liquidity, and regulatory risks. This careful assessment can help you make an informed decision on whether the gamble is truly worth it.