Blggzz: Your Daily Dose of Insight

Stay updated with the latest news and informative articles.

Unleashing Chaos: The Science Behind CSGO Force Buy Rounds

Discover the secrets of CSGO's force buy rounds! Unveil strategies and science that can turn chaos into victory in this thrilling guide.

Understanding the Mechanics of Force Buy Rounds in CSGO

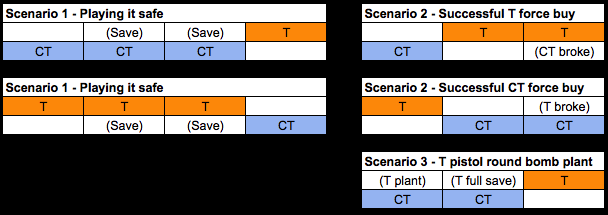

In Counter-Strike: Global Offensive (CS:GO), understanding the mechanics of force buy rounds is crucial for improving your gameplay strategy. A force buy round occurs when a team, despite having insufficient funds for a full buy, decides to purchase weapons and utility to maximize their chances of winning a round. This tactical decision can catch your opponents off guard and turn the tide of the game. Typically, players will prioritize spending on rifles and grenades, ensuring that they have a fighting chance against a well-armed enemy.

To effectively execute a force buy round, communication and teamwork are essential. Players must not only understand their individual roles but also how best to support one another in the heat of battle. Consider employing an aggressive strategy, such as overwhelming the opposing team with numbers or utilizing coordinated tactics to exploit weaknesses. Remember, the key lies in making calculated decisions based on the current state of the game and your team's economy. By mastering the nuances of force buys, you can significantly enhance your team's performance and create more opportunities for victory.

Counter-Strike is a popular multiplayer first-person shooter game that originally launched in 1999. It has since evolved through various iterations, gaining a massive following and becoming a staple in the esports scene. Players often seek to enhance their gameplay, and a crucial aspect of this is optimizing their crosshair settings. If you're interested in how to copy crosshair, you'll find many guides tailored to help you create the perfect aiming reticle.

Top Strategies for Successful Force Buy Rounds: A Comprehensive Guide

In the competitive landscape of force buy rounds, having a well-structured strategy is essential. One of the top strategies involves thorough market research. Understanding the dynamics of your target audience and the preferences of your stakeholders will allow you to tailor your offerings effectively. Furthermore, developing strong relationships with key decision-makers can significantly improve your chances of securing favorable buy-ins. To increase your chances of success, consider implementing the following tactics:

- Conduct detailed market analysis to identify trends.

- Leverage data analytics to forecast demand.

- Establish a clear communication channel with stakeholders.

Another critical aspect of successful force buy rounds is effective negotiation skills. Negotiation is not just about price; it's also about value perception. Build your case around the unique benefits your proposal brings. Tools such as SWOT analysis can help in presenting your strengths convincingly. It's also valuable to remain adaptable during negotiations. When embracing flexibility, you can review terms and make concessions that still align with your objectives. Lastly, remember to follow up post-negotiation to solidify relationships and keep lines of communication open, ensuring that you are well-positioned for future rounds.

Is a Force Buy Worth the Risk? Analyzing the Pros and Cons

The concept of a Force Buy in trading can be both enticing and daunting. On one hand, the potential for significant profit draws many traders to consider it as a strategy. The key advantage of a Force Buy is its ability to capitalize on unexpected price drops, allowing an investor to acquire assets at a fraction of their value. This opportunity can lead to substantial returns when the market rebounds. However, it is imperative for traders to be aware of the inherent risks involved. The possibility of further declines can lead to severe losses, making it essential to conduct thorough research and analysis before committing to a Force Buy.

On the other hand, executing a Force Buy can lead to emotional decision-making, primarily driven by fear of missing out (FOMO). For some traders, this may cloud judgment and lead to hasty investments without a solid strategy. Additionally, liquidity issues can arise, especially in less active markets where it might be challenging to sell the assets quickly at a favorable price. Considering these factors, it is crucial for traders to weigh the pros and cons carefully. A reliable risk management plan can help mitigate potential losses, but it should always be accompanied by a clear understanding of market conditions and personal risk tolerance.